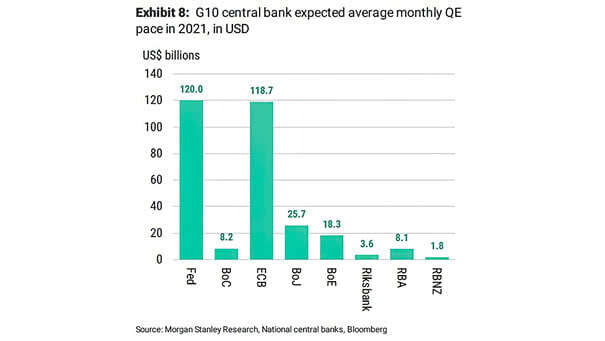

G10 Central Bank Expected Average Monthly Quantitative Easing (QE) in 2021

G10 Central Bank Expected Average Monthly Quantitative Easing (QE) in 2021 Central banks are expected to provide more liquidity to markets in 2021. Image: Morgan Stanley Research