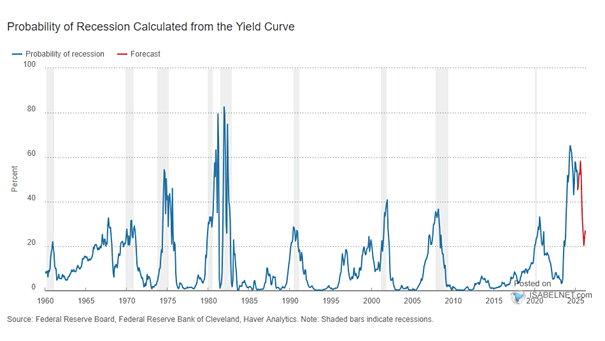

Probability of U.S. Recession Calculated from the Yield Curve

Probability of U.S. Recession Calculated from the Yield Curve The probability of U.S. recession in 12 months, calculated from the yield curve, stands at 25.6% in June. Image: Federal Reserve Bank of Cleveland