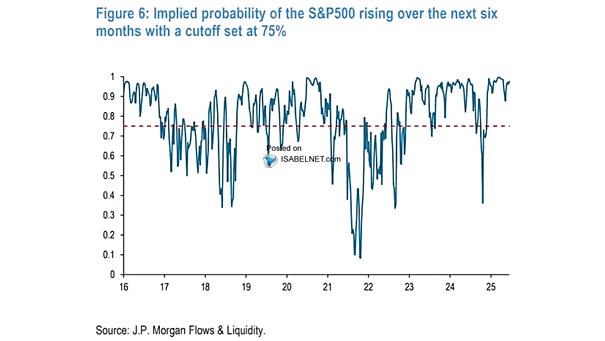

Implied Probability of the S&P 500 Rising over the Next Six Months with a Cutoff Set at 75%

Implied Probability of the S&P 500 Rising over the Next Six Months with a Cutoff Set at 75% JPMorgan’s AI-enhanced forecasting model indicates a 96% probability that U.S. stocks will rise over the next six months, giving investors a data-driven reason for optimism about the market outlook. Image: J.P. Morgan Flows and Liquidity