May

02

2025

Off

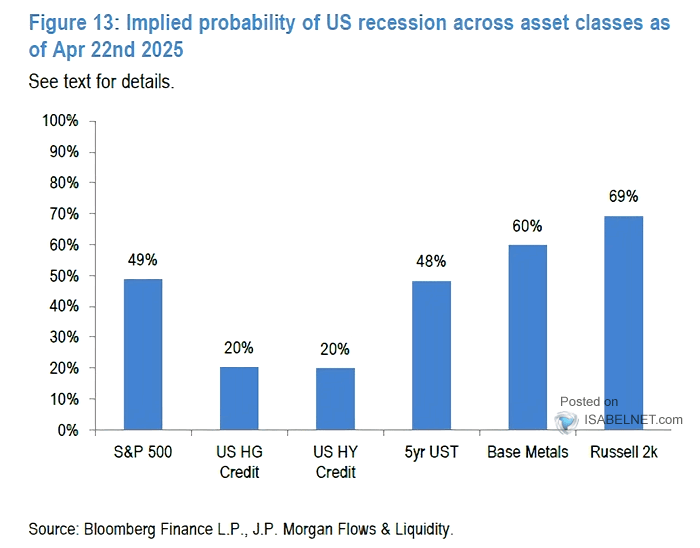

Probability of U.S. Recession As Priced Across Asset Classes

The S&P 500 is pricing in about a 25% chance of a recession, which is lower than signals from copper prices or the yield curve, but higher than the recession probabilities implied by global equities or high-yield credit markets.

Analysts often use the current percentage change in the S&P 500 index to gauge the likelihood of an impending U.S. recession, given historical trends. On average, the S&P 500 index has dropped about 31% during the last ten recessions. This statistic serves as a benchmark for predicting economic downturns, as significant declines in the stock market are often correlated with recessions.

Image: Bloomberg