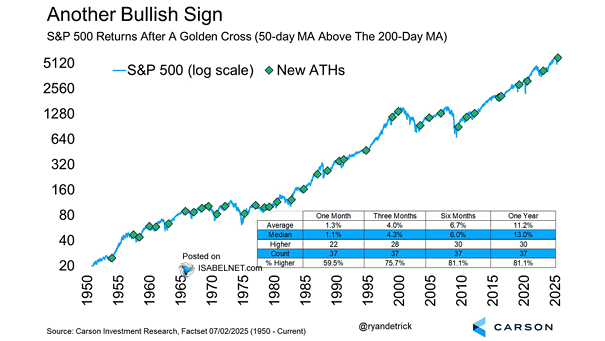

S&P 500 Returns After a Golden Cross (50-Day MA Above the 200-Day MA)

S&P 500 Returns After a Golden Cross (50-Day MA Above the 200-Day MA) Since 1950, the S&P 500’s golden cross has been a reliable bullish signal, generating median returns of 13% over the following year, with positive returns about 80% of the time—giving bulls plenty of reason to rejoice. Image: Carson Investment Research