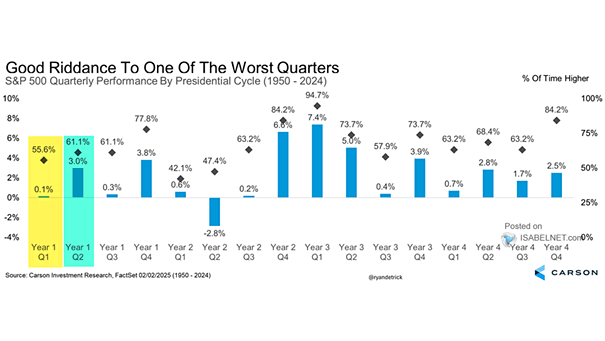

S&P 500 Index Quarterly Returns Based on the Four-Year Presidential Cycle

S&P 500 Index Quarterly Returns Based on the Four-Year Presidential Cycle In post-election years, Q1 tends to be weak. Q2 often shows stronger performance, while Q3 usually experiences some weakness. As the saying goes, “History doesn’t repeat itself, but it often rhymes.” Image: Carson Investment Research