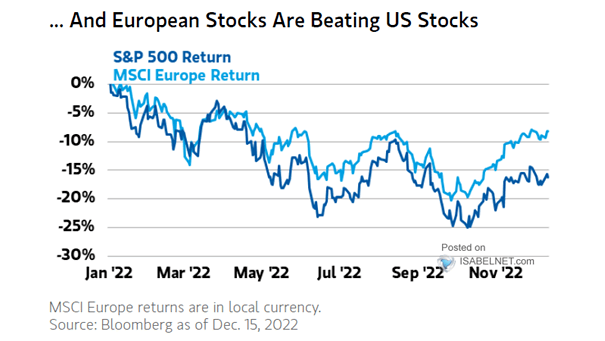

Performance – S&P 500 Return vs. MSCI Europe Return

Performance – S&P 500 Index vs. MSCI ACWI ex-US Despite rebounding after the tariff pause, the S&P 500 has not regained global equity leadership; European and Asian stocks have outperformed in 2025 due to better valuations and more stable policies. Image: Bloomberg