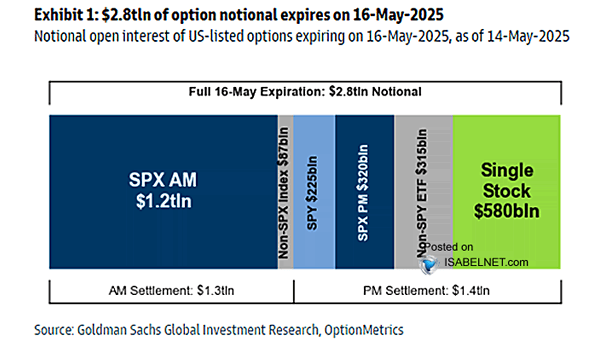

Volatility – U.S. Options Expiration

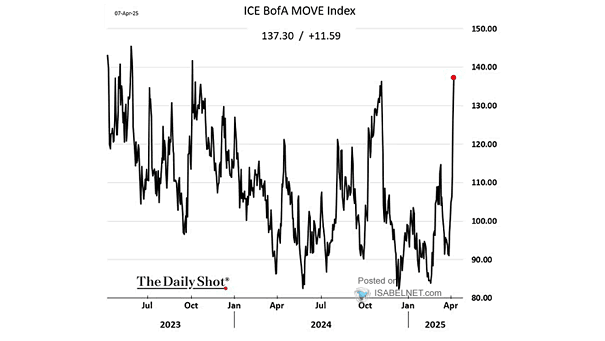

Volatility – U.S. Options Expiration The expiration of $5.9tn in options notional may lead to increased market volatility and price movements, driven by heightened trading activity, shifts in trader sentiment, and the mechanics in option exercise and settlement. Image: Goldman Sachs Global Investment Research