Volatility – VIX Curve and U.S. Election

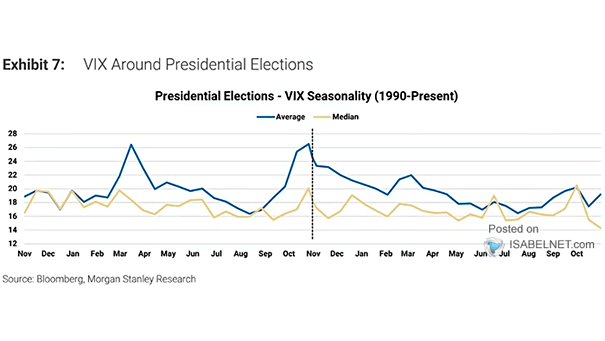

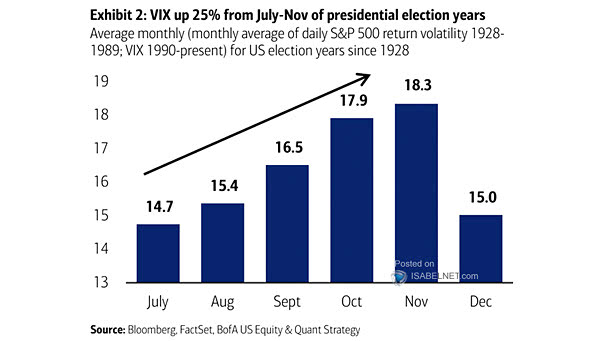

Volatility – VIX and U.S. Election The historical trend of the VIX spiking before U.S. elections and then rapidly declining afterward can be attributed to heightened uncertainty and investor fear in the lead-up to the elections. Image: Morgan Stanley Research