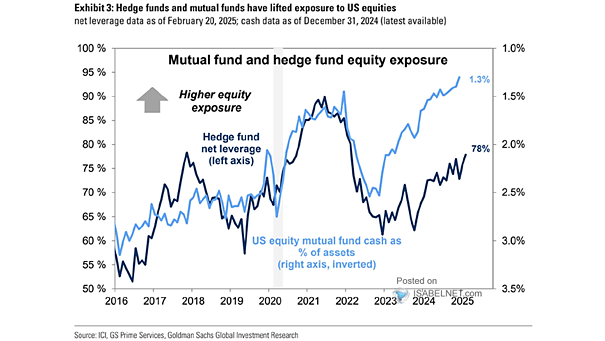

Hedge Fund and Mutual Fund Equity Exposure

Hedge Fund and Mutual Fund Equity Exposure In a sign of optimism about the current economic climate, hedge funds and mutual funds have collectively increased their stakes in U.S. equities, which paints a picture of growing confidence in the U.S. stock market. Image: Goldman Sachs Global Investment Research