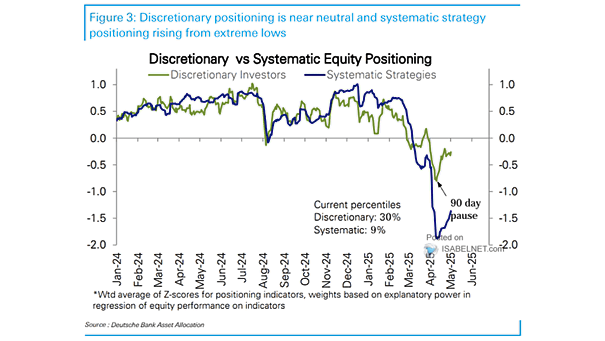

Discretionary vs. Systematic Equity Positioning

Discretionary vs. Systematic Equity Positioning Both discretionary investors and systematic strategies have raised their equity exposure to neutral levels, signaling a more balanced risk outlook amid ongoing uncertainties. Image: Deutsche Bank Asset Allocation