Euro to U.S. Dollar (EUR/USD)

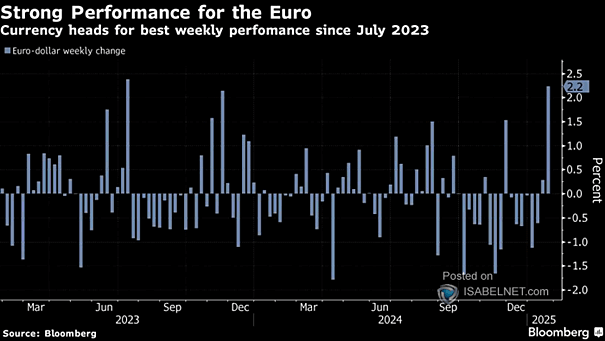

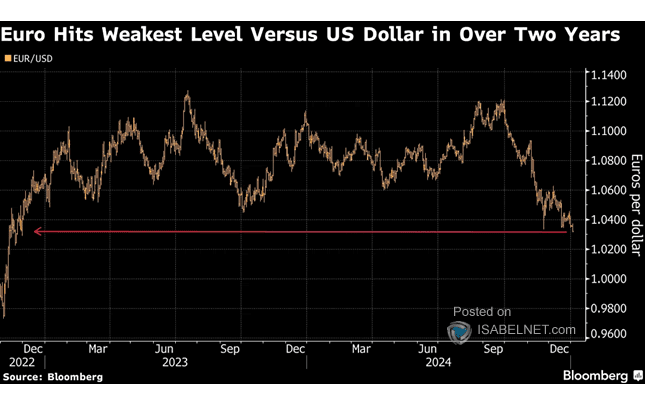

Euro to U.S. Dollar (EUR/USD) The euro has shown strength this week, but caution is warranted. Potential shifts in U.S. trade policy under Trump and ongoing economic disparities continue to give the dollar an edge. Image: Bloomberg