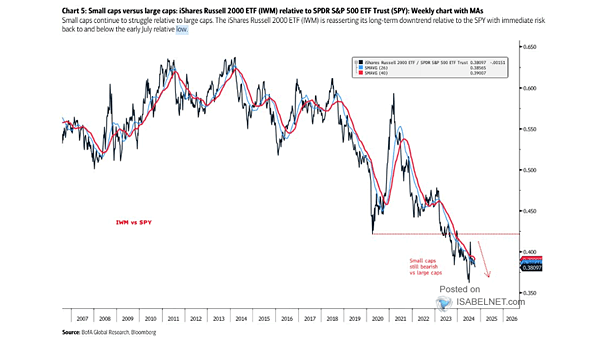

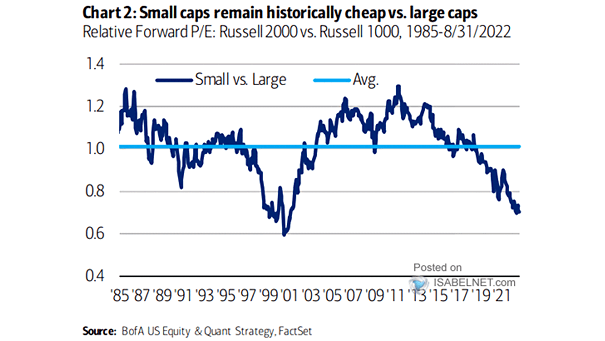

Performance – U.S. Small Cap Stocks vs. Large Cap Stocks

Performance – U.S. Small Cap Stocks vs. Large Cap Stocks Small caps continue to face significant challenges relative to large caps, a trend that has persisted for several years. However, there is a growing sense of cautious optimism about their potential recovery as market conditions change. Image: BofA Global Research