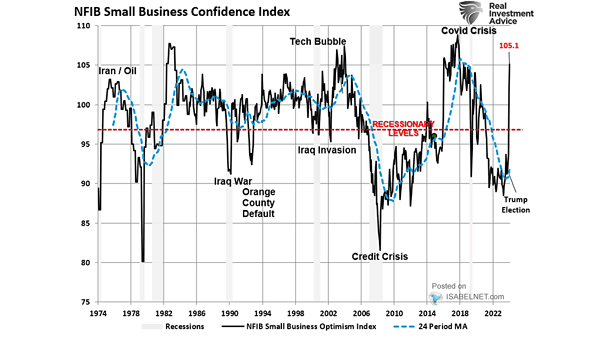

NFIB Small Business Confidence Index

NFIB Small Business Confidence Index With the NFIB Small Business Confidence Index at 91.5 in September, often linked to recessionary periods, U.S. small business owners appear increasingly pessimistic about both their businesses and the broader economic landscape. Image: Real Investment Advice