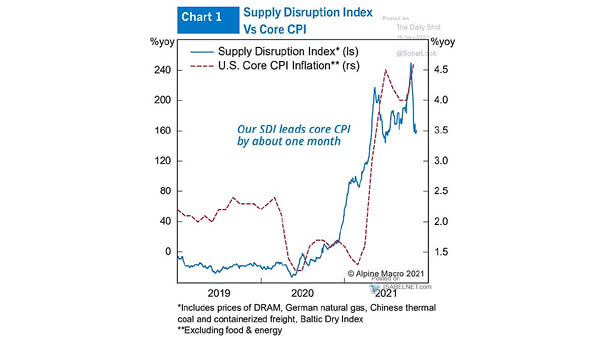

Supply Disruption Index vs. U.S. Core CPI Inflation (Leading Indicator)

Supply Disruption Index vs. U.S. Core CPI Inflation (Leading Indicator) Is U.S. core CPI inflation finally peaking? The supply disruption index tends to lead U.S. core CPI inflation by one month. Image: Alpine Macro