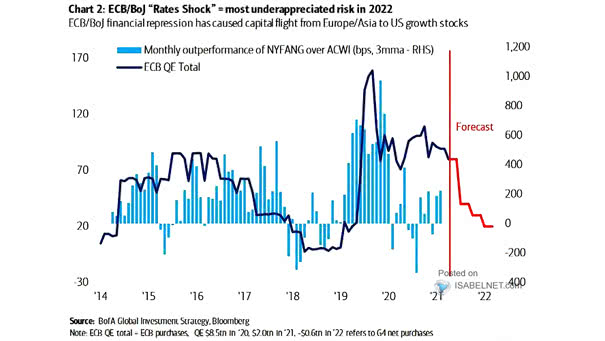

Monthly Outperformance of NYFANG Over ACWI and ECB QE Total

Monthly Outperformance of NYFANG Over ACWI and ECB QE Total Is the shock of central bank tightening in Europe and Japan the most underappreciated risk this year? Image: BofA Global Investment Strategy