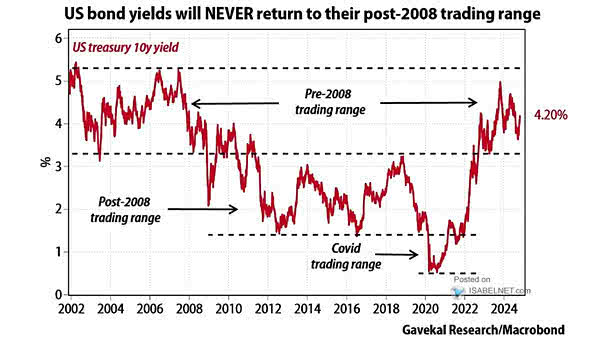

U.S. Bond Yields

U.S. Bond Yields The era of ultra-low interest rates that followed the 2008 financial crisis should be seen as a historical anomaly. It is unlikely that U.S. bond yields will return to their post-crisis lows. Image: Gavekal, Macrobond