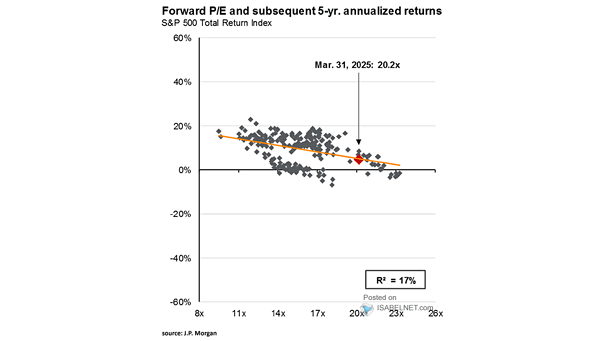

S&P 500 Forward P/E Ratio and Subsequent 5-Year Returns

Forward P/E Ratio and Subsequent 5-Year Annualized Returns Given current U.S. stock market valuations, investors may need to lower their expectations for equity returns over the next five years. Image: J.P. Morgan Asset Management