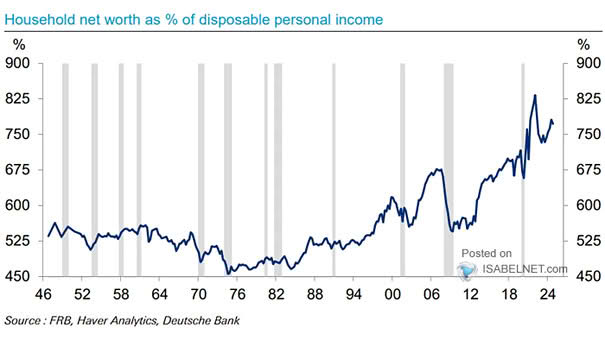

U.S. Household Net Worth as % of Disposal Personal Income

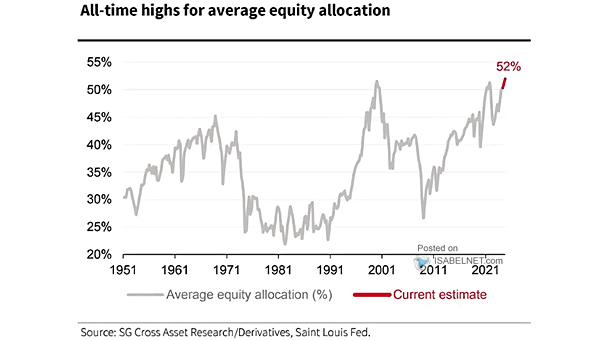

U.S. Household Net Worth as % of Disposal Personal Income In the U.S., the household net worth-to-income ratio is nearing historic highs, driven mainly by soaring stock and home values. Yet, wealth gains from the AI boom have largely favored the richest, intensifying the wealth gap. Image: Deutsche Bank