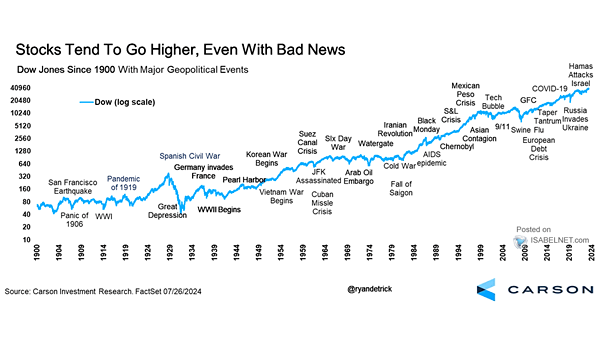

Stocks – Dow Jones with Major Geopolitical Events

Stocks – Dow Jones with Major Geopolitical Events Geopolitical events may trigger short-term market fluctuations, but historical evidence suggests that U.S. stocks have demonstrated a capacity to rebound and grow in the long run. Image: Carson Investment Research