Central Bank Gold Purchases

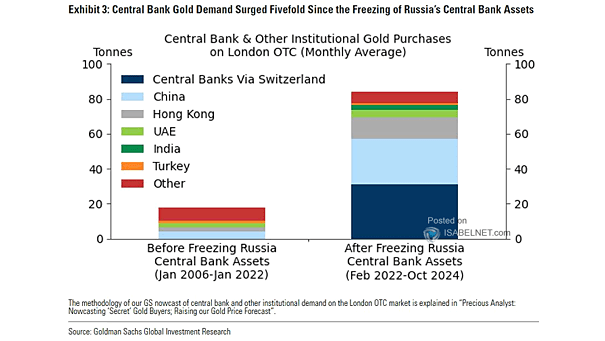

Central Bank Gold Purchases The freezing of Russia’s central bank assets has had a profound impact on global financial strategies, driving central banks to significantly increase their gold holdings as a safeguard against economic and geopolitical risks. Image: Goldman Sachs Global Investment Research