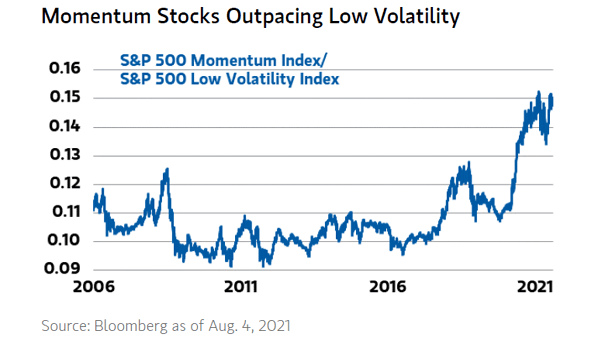

S&P 500 Momentum Index / S&P 500 Low Volatility Index

S&P 500 Momentum Index / S&P 500 Low Volatility Index Momentum stocks are outpacing low volatility stocks. Are investors concerned of higher market fragility? Image: Morgan Stanley Wealth Management