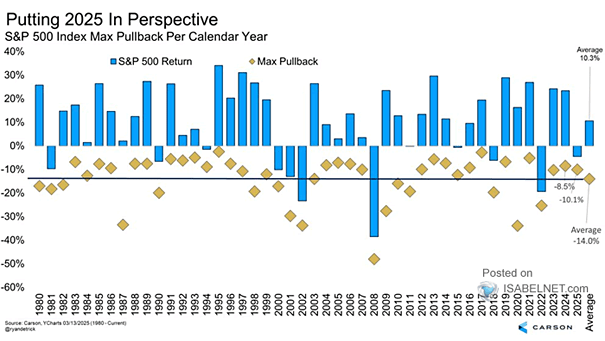

S&P 500 Index Max Pullback per Calendar Year

S&P 500 Index Max Pullback per Calendar Year Corrections can be unsettling for investors but don’t always signal a more severe downturn. Since 1980, the S&P 500 has had 16 corrections that didn’t lead to bear markets, resulting in an average gain of 9.5% for those years. Image: Carson Investment Research