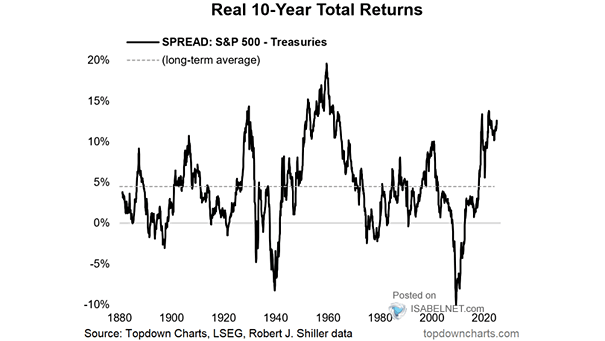

Real 10-Year Return – Spread: S&P 500 – Treasuries

Real 10-Year Return – Spread: S&P 500 – Treasuries Over the past decade, investors have reaped substantial rewards from equities, as stocks have significantly outperformed bonds. However, the outlook for the next ten years indicates that this trend may not persist. Image: Topdown Charts