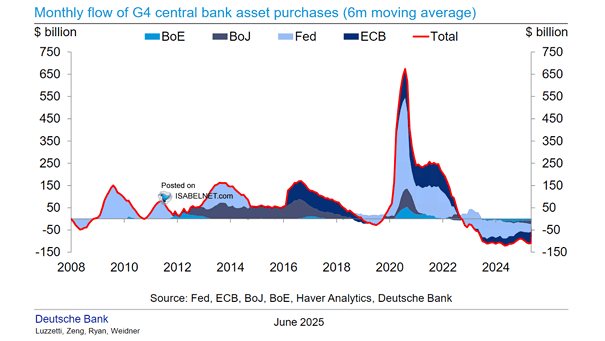

Monthly Flow of G4 Central Bank Asset Purchases

Monthly Flow of G4 Central Bank Asset Purchases Global central banks are continuing to reduce their asset holdings at a robust pace, primarily through balance sheet runoff and measured non-reinvestment of maturing securities. Image: Deutsche Bank