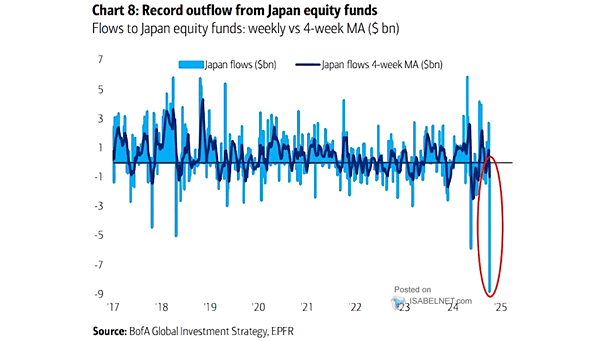

Flows to Japan Equities

Flows to Japan Equities While Japanese equities have faced significant outflows recently due to shifting investor sentiment, underlying structural reforms and an evolving economic landscape may provide opportunities for recovery in the future. Image: BofA Global Investment Strategy