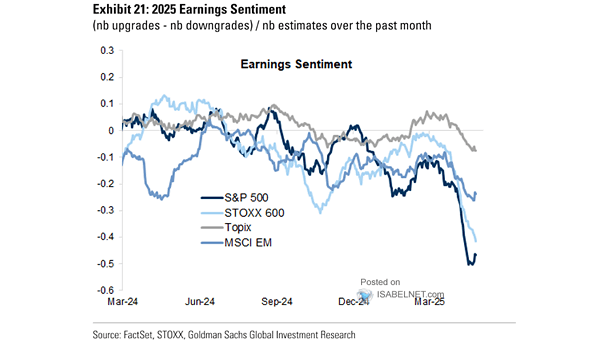

Earnings Sentiment (Analyst Upgrades Minus Downgrades Across Markets)

Earnings Sentiment (Analyst Upgrades Minus Downgrades Across Markets) Earnings sentiment for the S&P 500 has improved, with several key indicators pointing to robust corporate performance and potential for continued market growth. Image: Goldman Sachs Global Investment Research