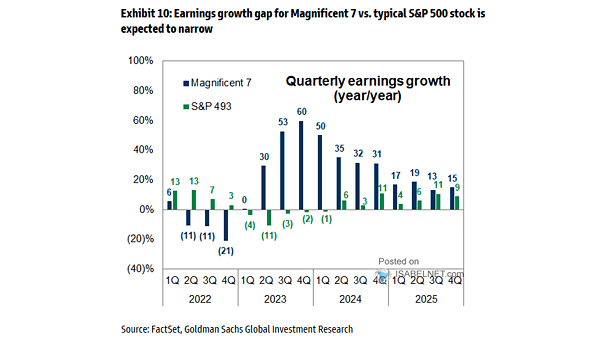

Earnings Growth

Earnings Growth Goldman Sachs anticipates a more diversified earnings landscape for the S&P 500, with the dominance of the Magnificent Seven tech giants moderating as other companies pick up the pace. Image: Goldman Sachs Global Investment Research