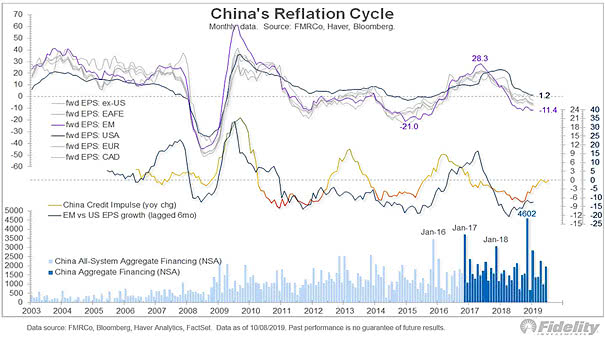

China Credit Impulse – Reflation Cycle

China Credit Impulse – Reflation Cycle This chart shows that China credit impulse has not yet boosted relative earnings. Credit impulse is the change in new credit issued as a percentage of GDP. Image: Fidelity Investments