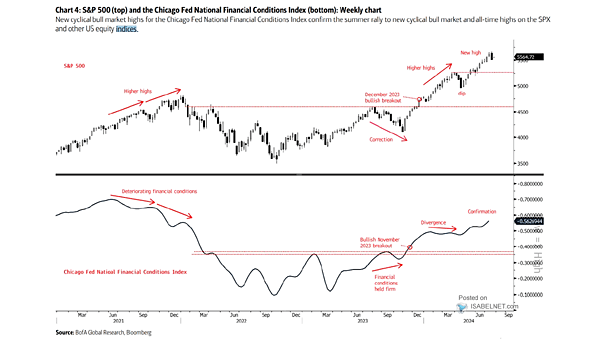

S&P 500 and Chicago Fed National Financial Conditions Index

S&P 500 and Chicago Fed National Financial Conditions Index Should investors stay optimistic? The rise in the Chicago Fed Financial Conditions Index is seen as a bullish signal for the S&P 500, suggesting potential for further upside. Image: BofA Global Research