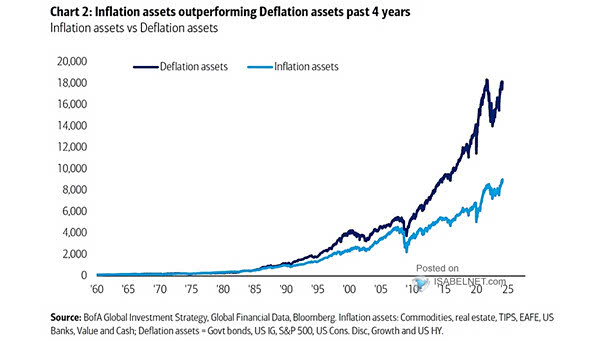

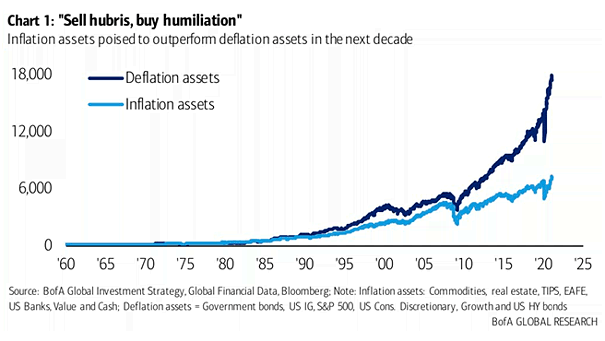

Inflation Assets and Deflation Assets

Inflation Assets and Deflation Assets In order to mitigate inflation risks, should investors increase their allocation to inflation assets and decrease their exposure to deflation assets in their portfolio? Image: BofA Global Investment Strategy