Brent Crude Oil vs. S&P 500 Index

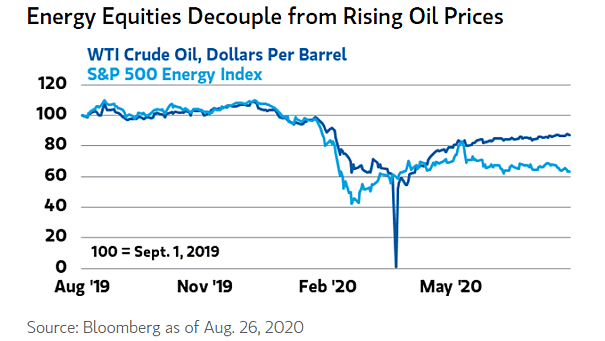

Brent Crude Oil vs. S&P 500 Index A short-term spike in oil prices may cause market jitters, but only a sustained, significant increase would meaningfully affect U.S. stocks and the broader economy; currently, economic and equity impacts remain limited. Image: Bloomberg