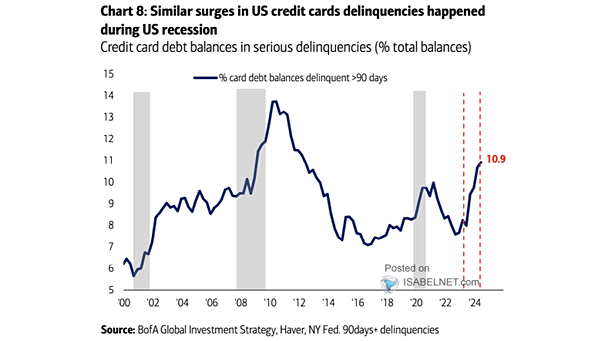

U.S. Credit Card Debt Balances in Serious Delinquencies

U.S. Credit Card Debt Balances in Serious Delinquencies Despite the rise in U.S. credit card delinquencies, the economy remains strong. Currently, there are no strong indicators that point to an impending recession. Image: BofA Global Investment Strategy