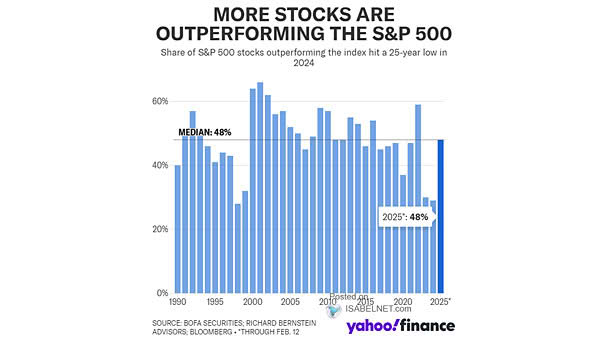

Performance – % of S&P 500 Stocks Outperforming the Benchmark by Year

Performance – % of S&P 500 Stocks Outperforming the Benchmark by Year Market leadership has broadened in 2025. Whereas a handful of large tech companies dominated in 2023 and 2024, more than half of S&P 500 stocks are now outperforming the index. Image: Ned Davis Research