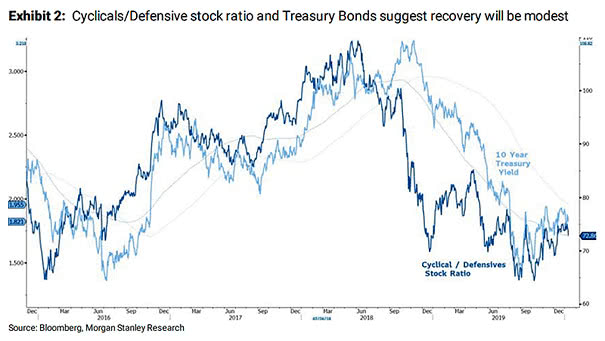

Cyclicals to Defensive Stock Ratio and Treasury Bonds

Cyclicals to Defensive Stock Ratio and Treasury Bonds Market internals, the preference for large over small and quality over junk, suggest that the recovery will be modest. Image: Morgan Stanley Research