U.S. Earnings Revision

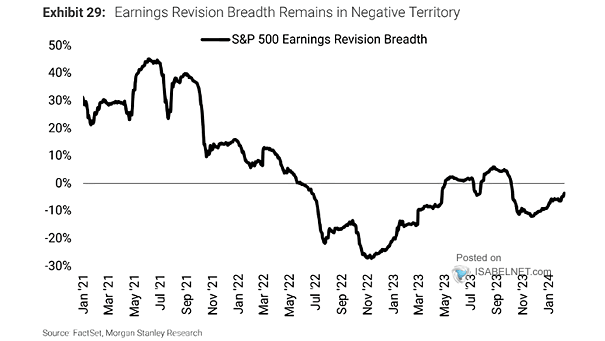

U.S. Earnings Revision The earnings revision ratio is showing an improving trend for small and large caps, while it is trending down for the Nasdaq 100. This divergence in earnings revisions could reflect changing market dynamics. Image: BofA US Equity & Quant Strategy