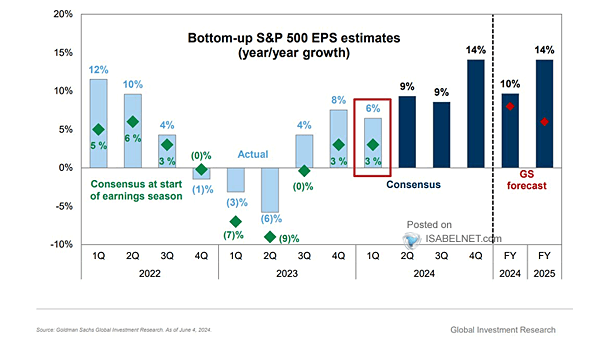

Bottom-Up Consensus S&P 500 EPS Estimates

Bottom-Up Consensus S&P 500 EPS Estimates Bottom-up consensus estimates show S&P 500 EPS growth slowing to 4% year-over-year in Q2 2025, highlighting a cautious earnings environment amid ongoing revisions and sector challenges. Image: Goldman Sachs Global Investment Research