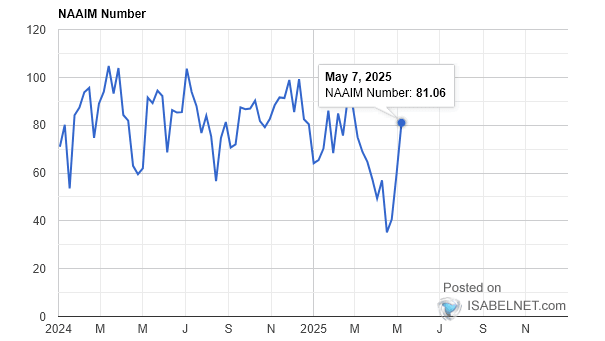

NAAIM Exposure Index – Investor Sentiment

NAAIM Exposure Index – Investor Sentiment With the NAAIM Exposure Index at 83.69, active investment managers appear confident and continue to hold significant positions in U.S. equities. The National Association of Active Investment Managers Exposure Index represents the two-week moving average exposure to U.S. equity markets reported by NAAIM members. Image: NAAIM