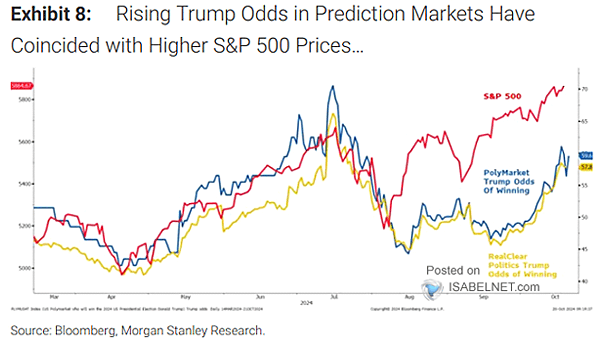

Odds of Winning U.S. Presidential Election

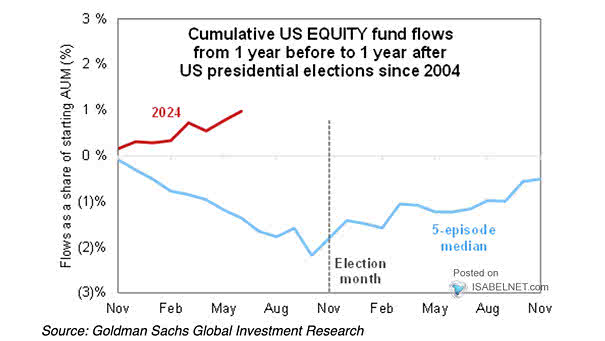

Odds of Winning U.S. Presidential Election Prediction market odds now strongly favor a Trump re-election victory in the 2024 presidential election, a development that may have significant consequences for global financial markets. Image: Goldman Sachs Global Investment Research