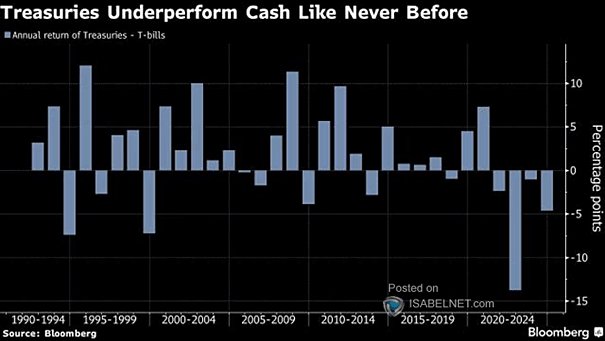

Annual Return of Treasuries – T-bills

Annual Return of Treasuries – T-bills In 2024, U.S. Treasuries have once again underperformed cash, resulting in a challenging year for bond investors. Many investors have found more appealing opportunities in cash savings or other asset classes. Image: Bloomberg