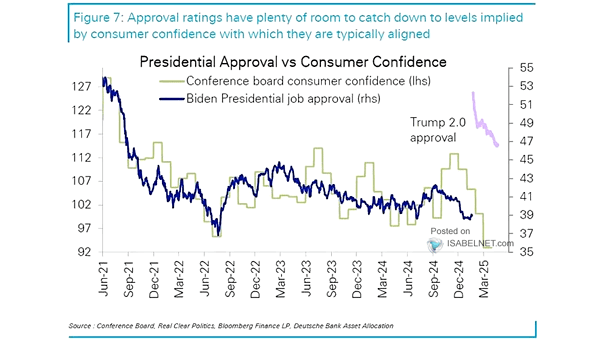

U.S. Presidential Approval Rating vs. Consumer Confidence

U.S. Presidential Approval Rating vs. Consumer Confidence Trump’s approval exceeds Biden’s late-term lows, but deteriorating consumer confidence’s predictive power signals substantial downside risk as economic anxieties translate into political consequences. Image: Deutsche Bank Asset Allocation