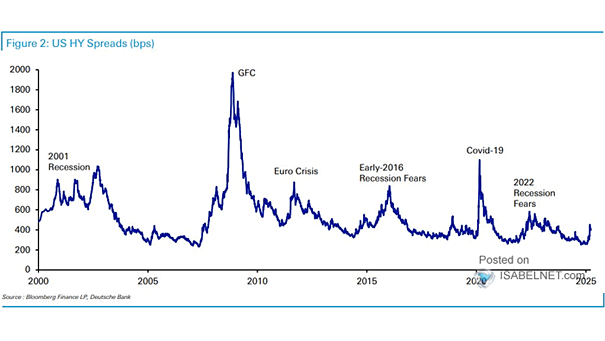

U.S. High Yield Credit Spreads and Recessions

U.S. High Yield Credit Spreads and Recessions U.S. high-yield credit spreads in May 2025 show little evidence of recession fears, remaining well below the levels seen during previous downturns. Image: Deutsche Bank