Oct

25

2019

Off

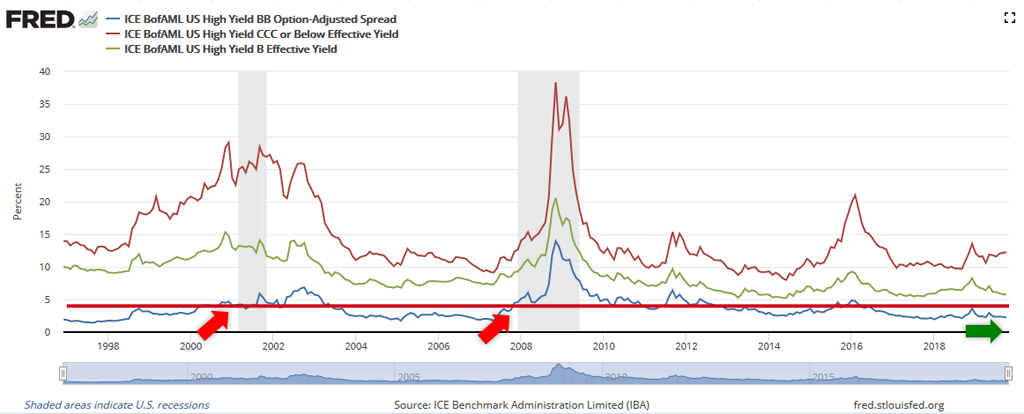

A Widening of High Yield Credit Spreads Is Very Useful to Predict a Recession

Like a yield curve inversion and real interest rates above real GDP, a widening of high yield credit spreads is very useful to predict a recession. At the present time, the bond market is not concerned about credit risk.