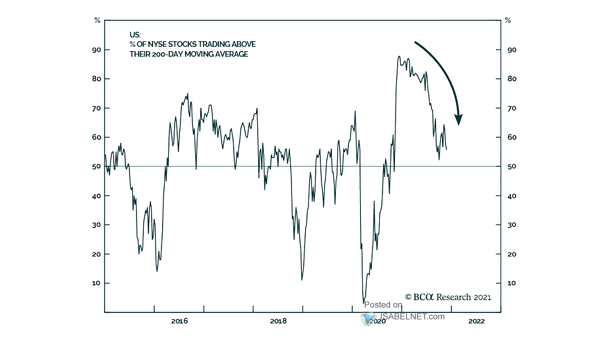

% of NYSE Stocks Trading Above Their 200-Day Moving Average

% of NYSE Stocks Trading Above Their 200-Day Moving Average Based on the percentage of NYSE stocks above their 200-day moving average, market breadth has weakened. Should investors be worried? Image: BCA Research