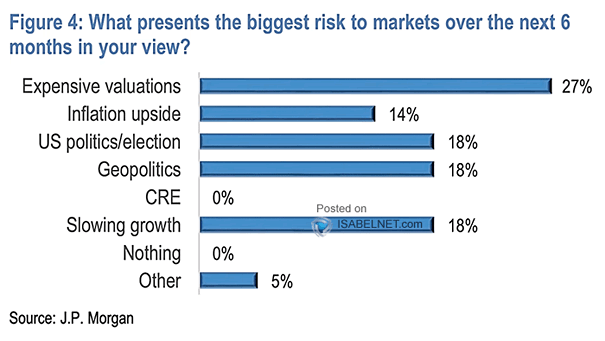

What Presents the Biggest Risk to Markets over the Next 6 Months in Your View?

What Presents the Biggest Risk to Markets over the Next 6 Months in Your View? According to a recent survey, 27% of JPM customers consider high valuations to be the biggest risk to markets, indicating a growing concern about the potential for overinflated asset prices. Image: J.P. Morgan