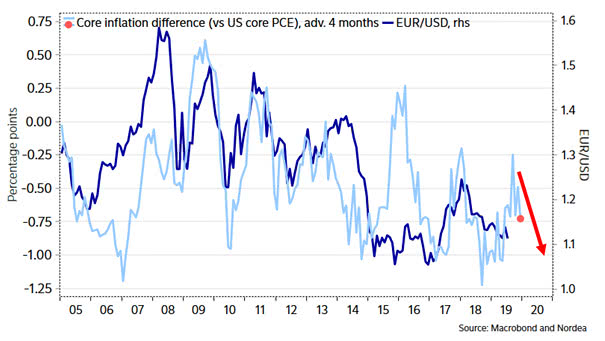

Core Inflation Difference (vs. U.S. core PCE) Leads EUR/USD

Core Inflation Difference (vs. U.S. core PCE) Leads EUR/USD This chart suggests that the core inflation difference (vs. U.S. core PCE) leads the EUR/USD by four months. Image: Nordea and Macrobond