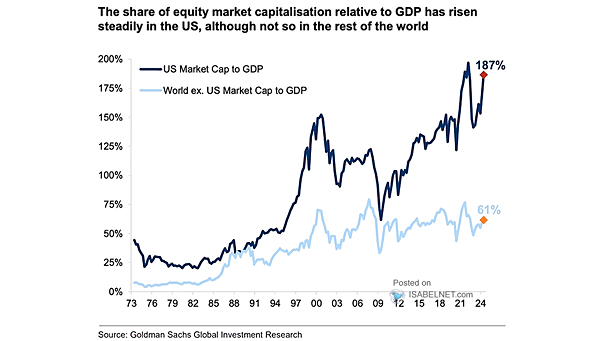

Valuation – U.S. Equity Market Capitalization to GDP

Valuation – U.S. Equity Market Capitalization to GDP The U.S. equity market cap to GDP ratio is near an all-time high at approximately 187%, suggesting a significant overvaluation of the U.S. stock market. Image: Goldman Sachs Global Investment Research