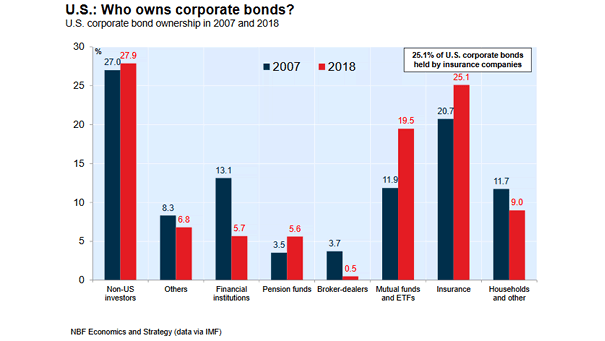

U.S. Corporate Bond Ownership

U.S. Corporate Bond Ownership More than 25% of U.S. corporate bonds are held by insurance companies. Many investment grade investors are not allowed to hold junk-rated bonds. Any drop in the credit ratings could amplify the next recession. Image: NBF Economics and Strategy