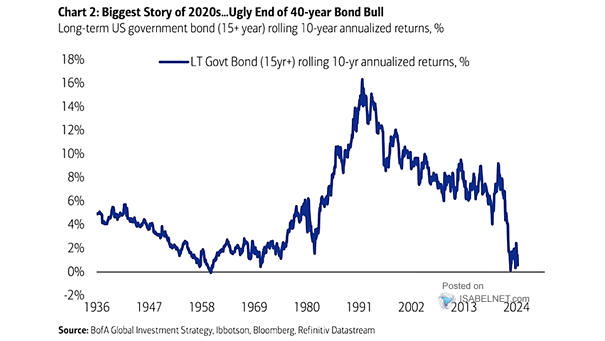

U.S. Long-Term Government Bond Returns

U.S. Long-Term Government Bond Returns The 10-year annualized return from U.S. Treasuries is at a 65-year low of just 0.6%, prompting investors to reassess portfolio allocation and risk management strategies. Image: BofA Global Investment Strategy