May

05

2019

Off

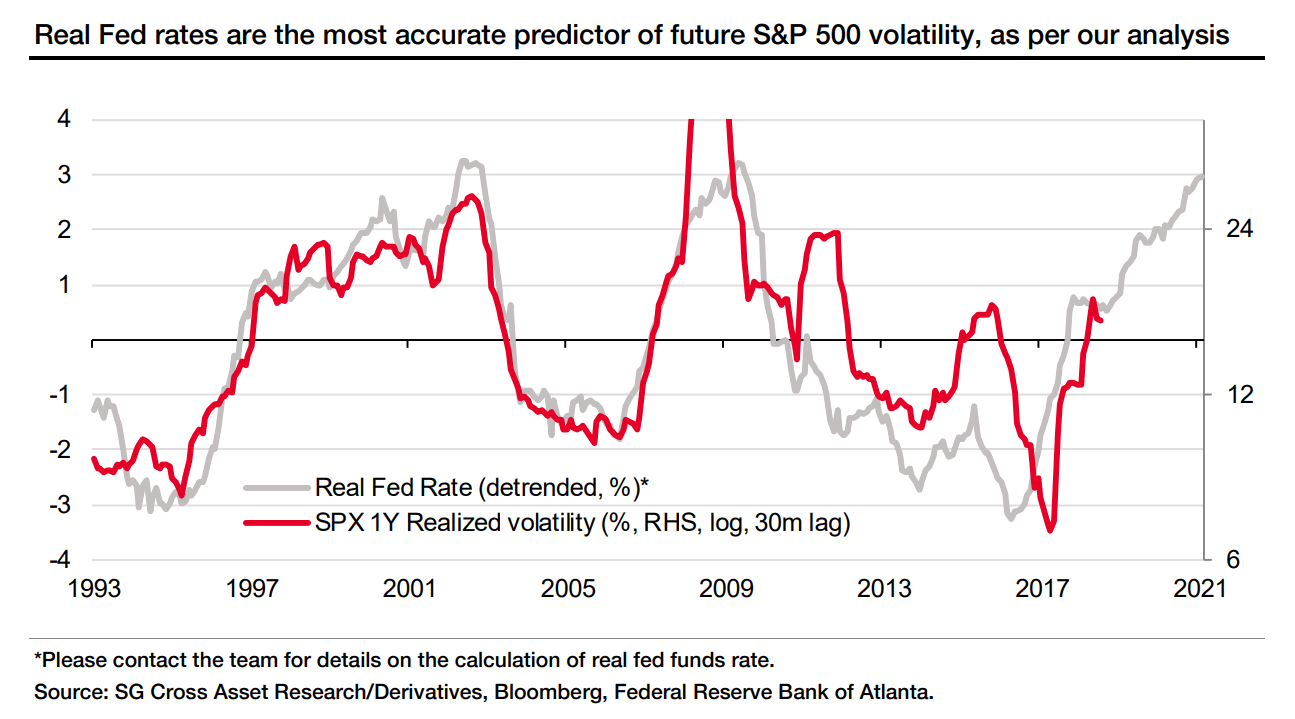

"Real Fed Rates Are the Most Accurate Predictor of Future S&P 500 Volatility," Says SocGen

SocGen says it is the most accurate predictor of S&P 500’s volatility over the last 50 years.

Should investors be nervous about rising real interest rates? Yes, higher real interest rates mean higher borrowing costs. The real Fed funds rate is the “true cost” of borrowing money. But keep in mind that investors have to wait about 30 months before the rise in the real fed funds rate causes stock market volatility.

See how real fed funds rates are very low compared to previous business cycles.